Morocco Description

Morocco Description

Morocco System Description

Overview on the coverage regime of the consequences of the Catastrophic Events of Morocco and the FSEC Institution

Morocco is a country moderately exposed to the risks of natural disasters, mainly seismic risk and flood risk. Over the past 20 years, Morocco has experienced a number of catastrophic events (the November 2002 floods in Mohammedia; the 24 February 2004 earthquake in Al Hoceima; the Gharb floods in 2008-2009, the Tangier floods in October 2008, December 2009 and January 2013 and the November 2014 floods in Guelmim). These events are likely to be exacerbated both in frequency and intensity in a context of Climate Change.

The damage caused by these disasters can have a significant impact on the socio-economic development of the country and harm the sustainable development of the affected territories, and indeed the country as a whole.

In 2014, the World Bank estimated that Morocco has a 90% chance of suffering a natural event causing losses of 10 billion dirhams in the next 30 years (nearly 1% of annual GDP).

Aware of this situation, the Moroccan authorities have put in place a national strategy for integrated risk management of natural disasters. This strategy goes beyond the management of crises that may result from these disasters to cover the entire cycle of their management (Risk Assessment, Prevention and Mitigation, Crisis Response and Management, Recovery and Reconstruction). The aim is to integrate the risk component into all development projects aimed at strengthening prevention, helping to strengthen the resilience of territories, and ensuring early recovery for effective reconstruction.

Work on the establishment of a national coverage regime for catastrophic events began in 2008, and led to the publication in 2016 of Law 110-14, which introduced a catastrophic risk coverage regime.

This scheme consists of two parts:

- An insurance component managed by insurance companies,

- A benefit component managed by the Fund of Solidarity against Disaster Events (FSEC) established by Law 110-14.

This law, effective on December 30th 2019, is guided by a number of principles including:

- Coverage of property and personal injury damage caused by major catastrophic events to which Morocco is exposed. The choice was made on a named perils cover:

- Natural disasters: earthquake, tsunami, flooding including sound, streams overflow, rising of the water table, breaking of dams caused by a natural phenomenon, sludge flows and floods,

- Man made disasters: terrorism, riots and civil commotions;

- Mandatory and universal coverage:

- Contributory insurance coverage of all insured persons by automatic extension to all existing policies covering both property damage and personal injury,

- Solidarity coverage by the FSEC of the entire Moroccan population not insured or insufficiently insured against catastrophic events that can cause property damage to the main houses and personal injury.

- The insurance scheme is financed by a statutory surcharge, covering the extension to catastrophic risks introduced by Law 110-14.

- The main resource of the FSEC is a parafiscal tax of 1% on non-life insurance contracts excluding workman compensation contracts.

The Solidarity Fund against Catastrophic Events (FSEC) was thus instituted by Law 110-14, in its chapter III, art 15, in a legal person of public law endowed with financial autonomy. The Director of the FSEC was appointed on 04 June 2019, so the first Board of Directors of the FSEC took place on 16 September 2019.

FSEC Mission and Objectives

The main mission of the FSEC is to mitigate the negative impacts that a catastrophic event generates on society by setting up a permanent regime of coverage of these events for any person in the national territory and victim of a catastrophic event.

To that end, FSEC will have to intervene in a number of areas of activity whose objectives defined by Law 110-14 are as follows:

- Compensate victims of catastrophic events;

- To grant loans to insurance and reinsurance undertakings under agreements which may be concluded with them for this purpose:

- insurance transactions relating to the guarantee against the consequences of catastrophic events referred to in Article 64-1 of Law No. 17-99 on the aforementioned insurance code;

- Reinsurance acceptance operations for risks covered under the guarantee against the consequences of the aforementioned catastrophic events.

- Contribute, under the conditions provided for in Article 229-1 of Law No. 17-99, to the guarantee granted by the State in accordance with the provisions of the same article;

- Formulate proposals and communicate them to the administration to improve the regime;

- Establish statistical and financial data on the consequences of catastrophic events and communicate them to the administration at the request of the latter;

FSEC Methodological Approach

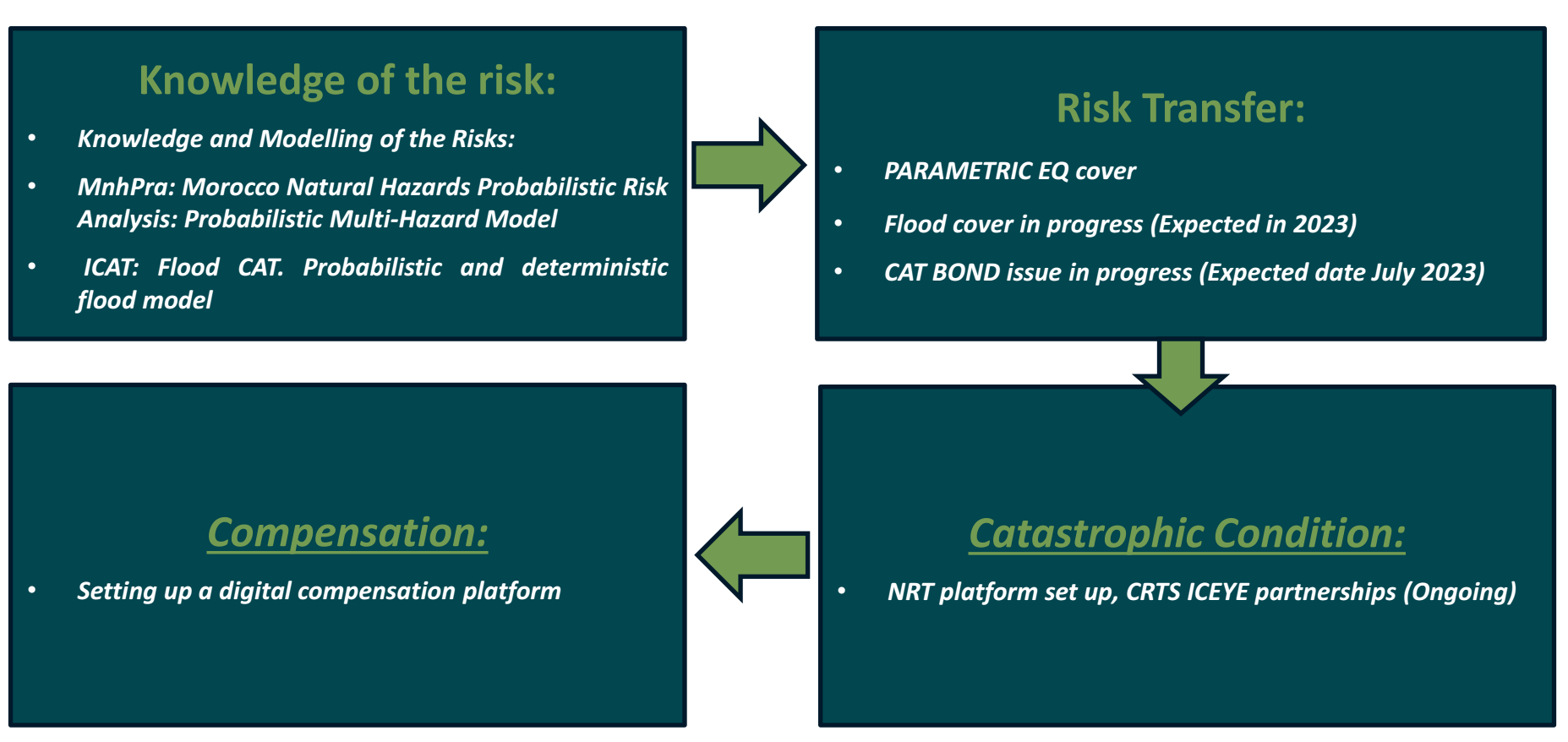

In order to ensure the coverage of catastrophic events defined by law 110-14 and carry out the missions established by said law, the Solidarity Fund against Catastrophic Events has implemented a methodological approach according to the 4 steps defined above-below:

I. Knowledge of the risk

II. Risk Transfer

III. Disaster Declaration

IV. Compensation Platform